For the next RM2000000. 10 of principle legal fee min RM300 and max RM1200.

The Complete Guide To Buying New Subsale Or Commercial Property In Malaysia

6A Jalan Sepadu Taman United 58200.

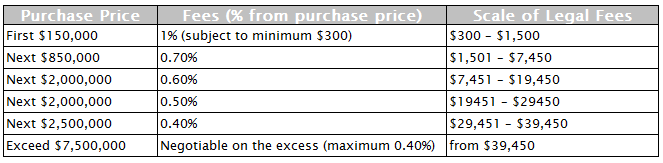

. Property Selling Price Market Value whichever is higher. Legal Fees Calculator. Home Interest Rates Update The latest Base Rate BR Base.

More tha RM 100000. This calculator calculates the estimated or approximate legal fees on SPA needed to be paid by buyers when purchasing a house in Malaysia. BLR and Base Financing Rate BFR as at 21st December 2018.

Negotiable but not more than 05. And Base Financing Rate BFR as at 21 December 2018 by Bank Negara Malaysia. This exemption is effective from the year of assessment of 2018 to 2020.

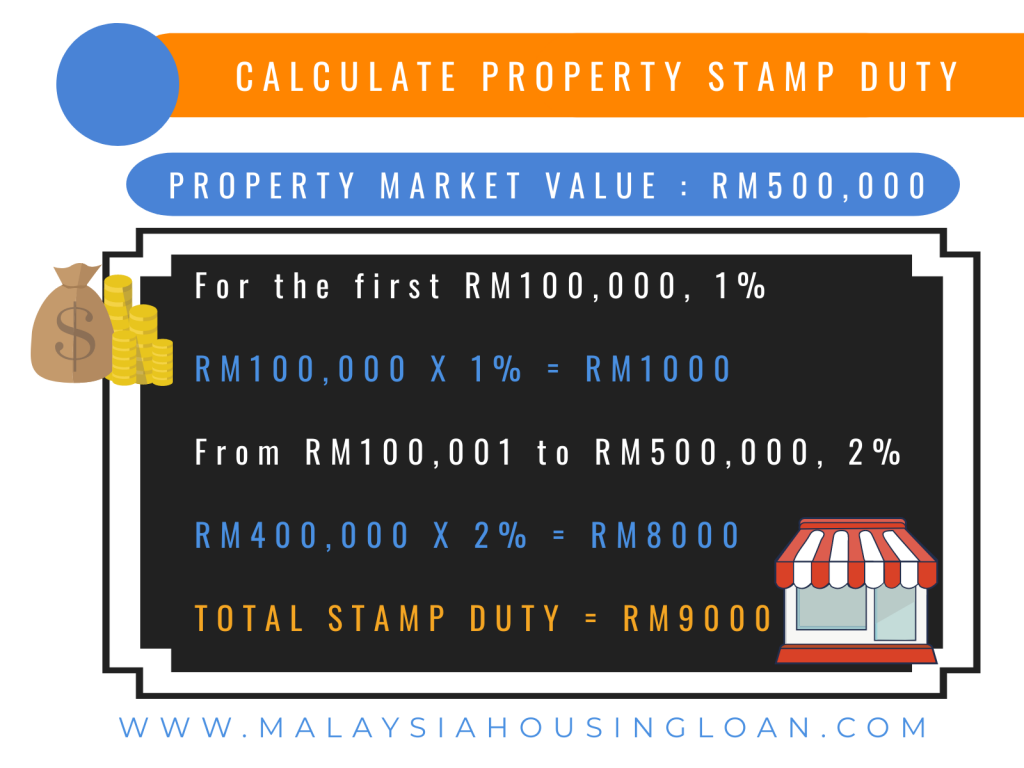

25 of the monthly rent. First RM100000 x 1 Next RM400000 x 2 05 of loan amount assuming 90 of property price RM450000 RM1000 RM8000 05 x RM450000 RM9000 RM2250. For the first RM500000.

Negotiable Shall not exceed 05 of such excess Notes. Home Stamp Duty Legal Fees 2018. For the next RM2000000.

Legal Fee Stamp Duty for Sale Purchase Agreement Loan. Scale of Legal Fee. This is profesional charge fees only that does not include disbursement.

This means that for a property at a purchase price of RM300000 the stamp duty will be RM5000. First RM 10000 rental. An advocate may charge interest at 14 per annum on his fees and disbursements from the expiration of one month from demand from the client.

For the first RM500000. When purchasing a house in Malaysia purchaser requires appointing a Sale Purchase SPA Lawyer to represent them. Luckily Low Partners created a handy Legal Fee and Stamp Duty calculator which you can easily use to calculate the exact amount you need to pay when buying and selling a property.

Tips For Appointing SPA Lawyer Mistakes Youll Never Make Again. The standard legal fees chargeable for tenancy agreement are as follows-. B1-32-3 Soho Suites KLCC No 20 Jalan Perak 50450 Kuala Lumpur Malaysia Branch.

For the next RM2500000. 10 subject to a minimum fee of RM500 For the next RM500000. MYR 7451 MYR 19450.

Both quotations will have slightly different in terms of calculation. Loan Facilities Legal Fees Formula. For the next RM500000.

MYR 19451 MYR 29450. For the next RM2000000. Fees from purchase price Legal Fees.

MYR 1501 MYR 7450. Legal Fees Calculator Stamp Duty Malaysia 2022. The stamp duty fee for the first RM100000 will be 1000001 RM1000 The stamp duty fee for the remaining amount will be 300000-1000012 RM4000.

For The First RM50000000 10 Subject to a minimum fee of RM50000 For The Next RM50000000 080. The calculations done by this calculator is an estimation of the Legal Fees on SPA for house purchase. Check out the listing here.

Property Purchase Price Loan Amount. The Government will also formulate the. Stamp duty for Memorandum of transfer in Malaysia MOT Malaysia can be extremely pricey and do check out the chart below for the tier rate.

100 subject to a minimum fee of RM50000 For the next RM500000. For the next RM2000000. Stamp duty for instrument of transfer Stamp duty on loan agreement Total stamp duty to be paid.

Shall not exceed 050. 1 min RM500 Next RM500000. Fill in the house price.

For The Next RM200000000 060. Lorong Api-Api 1 88000 Kota Kinabalu Sabah Malaysia Tel. First RM 10000 rental.

You will get a full summary after clicking Calculate button. SPA Loan Agreement quotation includes Legal fees amount Disbursement Fees 6 SST and stamp duty. Next RM 90000 rental.

Legal Fee for Tenancy Agreement period of above 3 years. For the next RM2000000. For The Next RM200000000 070.

November 1st 2021 UPDATES ON STAMP DUTY FOR YEAR 2022. To promote rental of residential homes for the first time in 60 years the Government proposes a 50 tax exemption on rental income received by resident individuals not exceeding RM2000 per month for resident individuals. Total Loan Amount X 050.

100 minimum MYR 300 MYR 300 MYR 1500. Consideration or Adjudicated Value. MYR 29451 MYR 39450.

20 of the monthly rent. For the next RM2500000. Paying for Legal Services.

Total Stamp Duty Payable by Purchaser. Professional Legal Fees to be included 6 of government tax. Calculating your legal fees and stamp duty can be confusing.

Memorandum Of Transfer Malaysia 2022 Malaysia Housing Loan

How To Calculate Legal Fees Stamp Duty For My Property Purchased Property Malaysia

Cukai Pendapatan How To File Income Tax In Malaysia

Stamp Duty On Mot Stamp Duty Calculator Malaysia Malaysiacalculator Com

How To Calculate Legal Fees Stamp Duty For My Property Purchased Property Malaysia

Memorandum Of Transfer Malaysia 2022 Malaysia Housing Loan

Memorandum Of Transfer Malaysia 2022 Malaysia Housing Loan

Experience 6 Nights 7 Days Of Absolute Wonder In The Sparkling Urban Landscapes Of Singapore Malaysia At A Jaw Dropping Travel Tours Tourism Tour Packages

Car Buying Legal Advice You Have To Know Car Buying Honda Fit Hybrid Honda Fit

Spa Stamp Duty Mot Calculator Legal Fees Calculator Properly

Simple Interest Calculator Audit Interest Paid Or Received

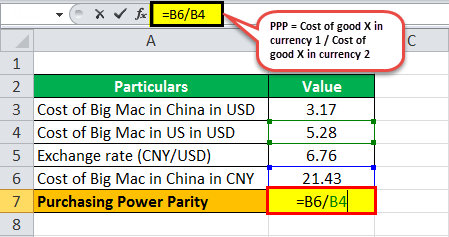

Purchasing Power Parity Formula Calculation Examples

How Should You Calculate Pay For International Remote Workers Eca International

Malaysia Personal Income Tax Calculator Malaysia Tax Calculator

Calculators Legal Fee Sale Purchase Agreement Loan Agreement

Purchasing Power Parity Formula Calculation Examples

Advantages And Disadvantages Of Gst In Malaysia Financial Aid For College Tax Software Mortgage Interest

Stamp Duty On Mot Stamp Duty Calculator Malaysia Malaysiacalculator Com